Will Writing Services

Single Standard Will - From £175.00 plus VAT

Standard Mirror Wills - From £300.00 plus VAT (for a married couple or long term partners)

Codicil or Amendments to your Will - From £100.00 plus VAT

Lasting Power of Attorney

Lasting Power of Attorney for Property & Financial Affairs - £300.00 plus VAT

Lasting Power of Attorney for Health & Welfare - £300.00 plus VAT

Registration of Enduring Power of Attorney - £300.00 plus VAT

There is also a registration fee of £82.00 payable to the Office of the Public Guardian for each document, which may be reduced if you are in receipt of means tested benefits.

Uncontested Probate & Estate Administration

Each estate varies in complexity and nature, therefore each case is dependent on what you would like us to do. The total costs will depend upon how straight forward or complicated the case is. For example, if someone has died leaving only one beneficiary in an undisputed will and no property, then costs would be at the lower end of the range because it will be simple to administer. If there are multiple beneficiaries, a property and multiple bank accounts however, costs will be at the higher end even if the will is still not disputed. For a quote that is specifically tailored to your case, please call us and we would be more than happy to help.

Our Fees are made up of the following;

Our Fees for Legal Work

Disbursements - a disbursement is a cost relating to your matter which is payable to a third party such as probate application fee. We handle this payment on your behalf.

Please note where VAT is referred to below, this is charged at the applicable rate which is 20%.

Our fixed fees:

Obtaining Grant of Probate Only - £1,000.00 plus 20% VAT

Obtaining Grant of Probate only consists of you providing us with all the assets and liabilities in the estate and we draft the relevant documents for you and deal with the probate registry directly on your behalf and receive the grant of probate. Thereafter, you obtain all the assets in the estate and deal with any liabilities due.

Estate Distribution

Estates up to £325,000.00 - our fee £1,750.00 plus VAT

Estates over £325,000.00 up to £900,000.00 - our fee £1,900.00 plus VAT, plus 1% of the gross estate

Estates over £900,000.00 - our fee £2,250.00 plus VAT, plus 1% of the gross estate

Our fees are based on estates where there is a valid Will, no claim against the estate and no dispute between beneficiaries.

Estates up to £325,000.00

The most common type of probate work that we deal with is estates valued up to £325,000.00. These estates are often the simple matters where someone has passed away leaving a valid will which is not disputed, the beneficiaries can be easily ascertained and there is not a very large or complex estate to divide up.

Our fees for this work will either be agreed with you as a fixed sum of £1,750.00 plus VAT at the start of our work together or based on how much time it takes to deal with your case. Our standard hourly rates are £130.00 plus VAT for our Wills and Probate Fee Earner and £190.00 plus VAT for a Partner. Normally this sort of matter takes between 15 and 20 hours work. Total costs therefore tend to be in the region of £1950.00 - £2,600.00 for Fee Earners (plus VAT at 20%) and in the region of £2,850.00 - £3,800.00 for partners. Typically our fix fees are cheaper than an hourly rate fee.

Estates from £325,000.00 - £900,000.00

Estate that are over £325,000.00 but under £900,000.00 are often much more complex in nature and often have multiple beneficiaries, assets and liabilities. For these estates, we charge a fixed fee of £1,900.00 plus 1% of the gross value of the estate plus VAT.

Estates over £900,000.00

Estate that are over £900,000.00 are the most complex of cases due to a number of different factors. One of which being inheritance tax. Therefore we charge a fixed fee of £2,250.00 plus VAT plus 1% of the gross value of the estate.

Probate and Estate Administration Disbursements

Disbursements are costs relating to your matter, payable to a third party.

Probate application fee - £273.00 (plus £1.50 per office copy of the grant)

Bankruptcy Searches - £2.00 per individual

Property valuations: £210.00 (estimate)

Shareholdings valuations: £200.00 (estimate)

Section 27 Notice: £300.00 - This is a legal notice that is posted in the London Gazette and can help protect the Executor against unexpected claims from unknown creditors. (estimate)

Land Registry OCE Fees: £3.00 per document

Potential Additional Costs

Dealing with the sale or transfer of any property in the estate is not included in the above costs. Please see our Residential Conveyancing Fees.

Examples of Estate Administration

An estate up to £325,000.00 - a deceased person has a property worth £125,000.00 together with £15,000.00 in the bank account and £12,000.00 in savings and investment. The gross estate has been valued at £152,000.00. A grant of probate is needed for the sale of the property and the Executor wants to put a Notice in the London Gazette so that they can inform any unknown creditors that the individual has passed away. The Executor is also the beneficiary. Our charges would be;

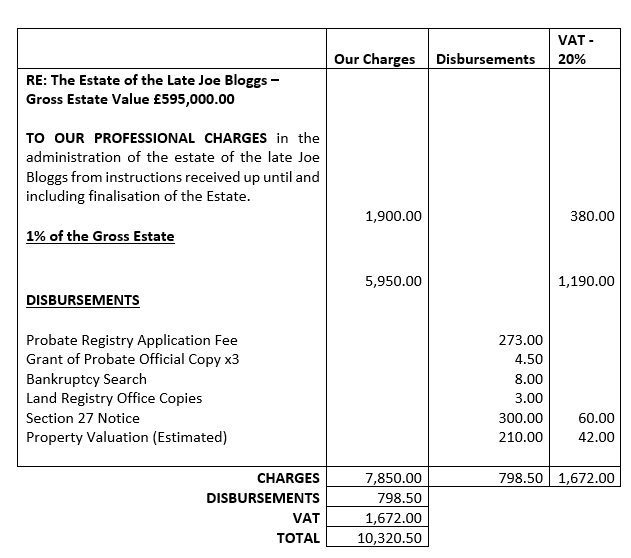

An estate up to £325,000.00 - £900,000.00 - a deceased person has a property worth £400,000.00 together with £45,000.00 in the bank account and £150,000.00 in savings and investment. The gross estate has been valued at £595,000.00. A grant of probate is needed for the sale of the property and the Executor wants to put a Notice in the London Gazette so that they can inform any unknown creditors that the individual has passed away. There are four beneficiaries and we need to make sure they aren’t bankrupt. There is inheritance tax due. Our charges would be;

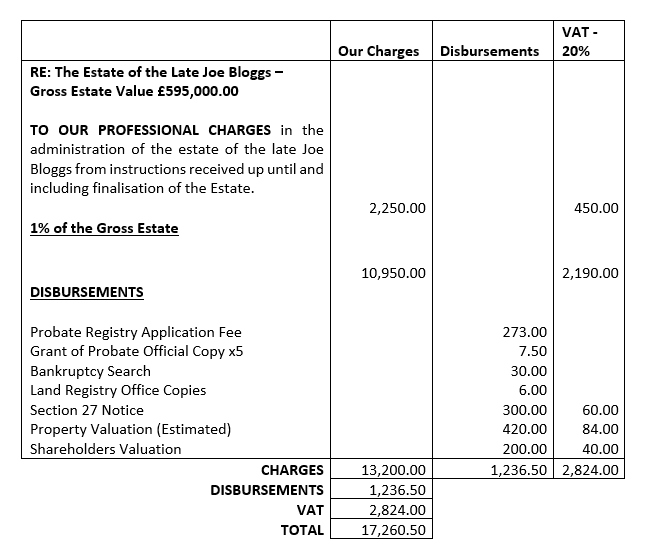

An estate over £900,000.00 - a deceased person has a property worth £500,000.00 and another property worth £250,000.00 together with £145,000.00 in the bank account, £150,000.00 in savings and investment and £50,000.00 in various stocks and shares. The gross estate has been valued at £1,095,000.00. A grant of probate is needed for the sale of the properties and the bank accounts and most likely the shares. The Executors wants to put a Notice in the London Gazette so that they can inform any unknown creditors that the individual has passed away. There are fifteen beneficiaries and we need to make sure they aren’t bankrupt. There is inheritance tax due. Our charges would be;

Key stages of your case:

The precise stages involved vary according to the circumstances. The ‘basic’ process for Estate Administration when a grant is required is as follows;

identifying the Executors and Beneficiaries

gathering information and collating the deceased’s assets and liabilities.

obtaining a valuation of the deceased’s property/properties.

corresponding with all the relevant parties (i.e. any banks, building society, shares companies, utility companies etc.).

completing the relevant inheritance tax forms and dealing with any inheritance tax liability.

completing the probate application forms and obtaining the grant.

collect all the assets from banks, building societies, selling any shares held in the deceased’s name.

paying off any debts owed.

providing the grant to the conveyancing department to deal with the sale of any property/properties.

distributing the estate in accordance with the terms of the Will.

How long do estates take?

Every estate is different and the key stages above are normally dealt with within 8 - 12 months. The length of time it will take to administer the estate depends on the individual circumstances of each matter. Please note that our fees above our guidance only.

If you have any questions or queries, please contact our Wills and Probate Department and we will be able to help you further. Please call 01937 832371 or you can email legal@bjhsolicitors.co.uk.